What Lesson Was Learned From The Imposition Of The Smootã¢â‚¬â€œhawley Tariff?

| |

| Long title | An Act To provide revenue, to regulate commerce with strange countries, to encourage the industries of the Usa, to protect American labor, and for other purposes. |

|---|---|

| Nicknames | Smoot–Hawley Tariff, Hawley–Smoot Tariff |

| Enacted by | the 71st United States Congress |

| Effective | March 13, 1930 |

| Citations | |

| Public law | Pub.L. 71–361 |

| Statutes at Large | ch. 497, 46 Stat. 590 |

| Codification | |

| U.S.C. sections created | 589 |

| Legislative history | |

| |

The Tariff Act of 1930 (codified at 19 United states of americaC. ch. four), commonly known as the Smoot–Hawley Tariff or Hawley–Smoot Tariff,[ane] was a law that implemented protectionist merchandise policies in the United States. Sponsored by Senator Reed Smoot and Representative Willis C. Hawley, it was signed past President Herbert Hoover on June 17, 1930. The act raised The states tariffs on over twenty,000 imported goods.[2]

The tariffs nether the act, excluding duty-gratuitous imports (see Tariff levels below), were the 2nd highest in Usa history, exceeded by only the Tariff of 1828.[3] The Act prompted retaliatory tariffs by affected states against the U.s..[4] The Act and tariffs imposed by America'southward trading partners in retaliation were major factors of the reduction of American exports and imports by 67% during the Depression.[5] Economists and economic historians have a consensus view that the passage of the Smoot–Hawley Tariff worsened the effects of the Bully Depression.[6]

Sponsors and legislative history [edit]

Willis C. Hawley (left) and Reed Smoot in April 1929, soon before the Smoot–Hawley Tariff Human action passed the House of Representatives.

In 1922, Congress passed the Fordney–McCumber Tariff Act, which increased tariffs on imports.[ citation needed ]

The League of Nations' World Economical Conference met at Geneva in 1927, last in its final study: "the fourth dimension has come up to put an finish to tariffs, and to motility in the reverse direction." Vast debts and reparations could exist repaid just through gold, services, or goods, but the only items available on that calibration were goods. However, many of the delegates' governments did the opposite; in 1928, France was the commencement by passing a new tariff law and quota system.[7]

By the late 1920s, the The states economy had made exceptional gains in productivity because of electrification, which was a disquisitional factor in mass production. As well, horses and mules had been replaced by motorcars, trucks, and tractors. One sixth to one quarter of farmland, which had been devoted to feeding horses and mules, was freed up, contributing to a surplus in subcontract produce. Although nominal and real wages had increased, they did non keep up with the productivity gains. As a result, the ability to produce exceeded market demand, a condition that was variously termed overproduction and underconsumption.[ citation needed ]

Senator Smoot contended that raising the tariff on imports would alleviate the overproduction problem, simply the United States had actually been running a trade business relationship surplus, and although manufactured goods imports were rising, manufactured exports were rising even faster. Food exports had been falling and were in trade account deficit, but the value of food imports were a petty over half of the value of manufactured imports.[viii]

As the global economic system entered the offset stages of the Great Depression in late 1929, the primary goal of the US was to protect its jobs and farmers from foreign competition. Smoot championed another tariff increase inside the United States in 1929, which became the Smoot–Hawley Tariff Neb. In his memoirs, Smoot made information technology abundantly articulate:

The world is paying for its ruthless devastation of life and property in the Globe State of war and for its failure to adjust purchasing power to productive chapters during the industrial revolution of the decade following the state of war.[ix]

Smoot was a Republican from Utah and chairman of the Senate Finance Committee. Willis C. Hawley, a Republican from Oregon, was chairman of the Firm Ways and Means Committee.[ commendation needed ]

During the 1928 presidential election, i of Herbert Hoover's promises was to aid beleaguered farmers by increasing tariffs on agricultural products. Hoover won, and Republicans maintained comfortable majorities in the Business firm and the Senate during 1928. Hoover and so asked Congress for an increase of tariff rates for agricultural goods and a decrease of rates for industrial goods.[ citation needed ]

Senate vote by state

Ii Yeas

Two Nays

One Yea and One Nay

One Yea and I Abstention

One Nay and One Abstention

2 Abstentions

The House passed a version of the act in May 1929, increasing tariffs on agricultural and industrial appurtenances akin. The House bill passed on a vote of 264 to 147, with 244 Republicans and twenty Democrats voting in favor of the bill.[10] The Senate debated its bill until March 1930, with many members trading votes based on their states' industries. The Senate beak passed on a vote of 44 to 42, with 39 Republicans and 5 Democrats voting in favor of the bill.[10] The conference commission then unified the 2 versions, largely by raising tariffs to the higher levels passed by the House.[11] The House passed the conference bill on a vote of 222 to 153, with the support of 208 Republicans and 14 Democrats.[ten]

Opponents [edit]

In May 1930, a petition was signed past 1,028 economists in the United States asking President Hoover to veto the legislation, organized past Paul Douglas, Irving Fisher, James T.F.G. Wood, Frank Graham, Ernest Patterson, Henry Seager, Frank Taussig, and Clair Wilcox.[12] [13] Automobile executive Henry Ford as well spent an evening at the White House trying to convince Hoover to veto the bill, calling it "an economical stupidity",[14] while J. P. Morgan's Main Executive Thomas Due west. Lamont said he "well-nigh went down on [his] knees to beg Herbert Hoover to veto the asinine Hawley–Smoot tariff".[15]

While Hoover joined the economists in opposing the bill, calling it "roughshod, extortionate, and obnoxious" because he felt it would undermine the delivery he had pledged to international cooperation, he somewhen signed the nib later he yielded to influence from his own party, his Cabinet (who had threatened to resign), and business leaders.[16]

Hoover'due south fears were well founded, equally Canada and other countries raised their own tariffs in retaliation after the beak had become law.[17]

Franklin D. Roosevelt spoke confronting the human activity during his campaign for President in 1932.[eleven]

Retaliation [edit]

Most of the decline in trade was due to a plunge in GDP in the Usa and worldwide. Yet beyond that was boosted decline. Some countries protested and others too retaliated with merchandise restrictions and tariffs. American exports to the protesters fell 18% and exports to those who retaliated fell 31%.[18]

Threats of retaliation by other countries began long before the bill was enacted into police force in June 1930. As the Business firm of Representatives passed it in May 1929, boycotts broke out, and foreign governments moved to increase rates against American products, although rates could exist increased or decreased by the Senate or past the conference committee. By September 1929, Hoover's assistants had received protest notes from 23 trading partners, but the threats of retaliatory deportment were ignored.[11]

In May 1930, Canada, the country's almost loyal trading partner, retaliated by imposing new tariffs on 16 products that accounted altogether for around xxx% of US exports to Canada.[nineteen] Canada afterward also forged closer economic links with the British Empire via the British Empire Economical Conference of 1932, while France and Britain protested and developed new trade partners, and Germany adult a system of merchandise via immigration.

The low worsened for workers and farmers despite Smoot and Hawley'due south promises of prosperity from loftier tariffs; consequently, Hawley lost re-nomination, while Smoot was 1 of 12 Republican Senators who lost their seats in the 1932 elections, with the swing being the largest in Senate history (being equalled in 1958 and 1980).[20]

Tariff levels [edit]

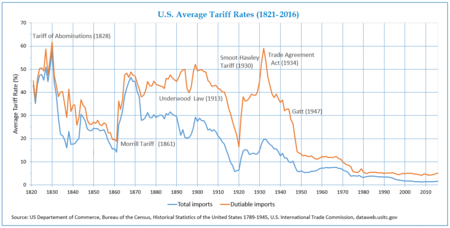

Average Tariff Rates in USA (1821–2016)

In the two-volume serial published past the US Bureau of the Census, "The Historical Statistics of the United States, Colonial Times to 1970, Bicentennial Edition", tariff rates have been represented in two forms. The dutiable tariff rate pinnacle of 1932 was 59.1%, second only to the 61.vii% rate of 1830.[21]

However, 63% of all imports in 1933 were non taxed, which the dutiable tariff charge per unit does non reflect. The costless and dutiable rate in 1929 was 13.5%, and peaked under Smoot–Hawley in 1933 at xix.8%, one-3rd below the boilerplate 29.7% "costless and dutiable rate" in the United States from 1821 to 1900.[22]

The average tariff rate on dutiable imports[23] [24] increased from 40.i% in 1929 to 59.1% in 1932 (+nineteen%). However, it had already been consistently at high levels between 1865 and 1913 (from 38% to 52%), and it had also risen sharply in 1861 (from eighteen.61% to 36.ii%; +17.59%), between 1863 and 1866 (from 32.62% to 48.33%; +15.71%), and betwixt 1920 and 1922 (from xvi.four% to 38.i%; +21.7%) without producing global depressions.[ citation needed ]

Subsequently enactment [edit]

At first, the tariff seemed to be a success. According to historian Robert Sobel, "Factory payrolls, structure contracts, and industrial product all increased sharply." However, larger economic problems loomed in the guise of weak banks. When the Creditanstalt of Republic of austria failed in 1931, the global deficiencies of the Smoot–Hawley Tariff became apparent.[16]

US imports decreased 66% from $four.4 billion (1929) to $1.five billion (1933), and exports decreased 61% from $5.iv billion to $ii.1 billion. GNP fell from $103.1 billion in 1929 to $75.8 billion in 1931 and bottomed out at $55.6 billion in 1933.[25] Imports from Europe decreased from a 1929 loftier of $ane.three billion to only $390 million during 1932, and The states exports to Europe decreased from $2.three billion in 1929 to $784 million in 1932. Overall, world trade decreased by some 66% between 1929 and 1934.[26]

Using panel data estimates of consign and import equations for 17 countries, Jakob B. Madsen (2002) estimated the effects of increasing tariff and non-tariff trade barriers on worldwide trade from 1929 to 1932. He concluded that existent international trade contracted somewhere around 33% overall. His estimates of the impact of various factors included about 14% considering of failing GNP in each state, 8% because of increases in tariff rates, 5% because of deflation-induced tariff increases, and 6% because of the imposition of not-tariff barriers.[ citation needed ]

The new tariff imposed an effective revenue enhancement rate of lx% on more than 3,200 products and materials imported into the United States, quadrupling previous tariff rates on individual items but raising the boilerplate tariff rate to xix.2%, which was in line with boilerplate rates of that day.[ citation needed ]

Unemployment was 8% in 1930 when the Smoot–Hawley Act was passed, just the new law failed to lower it. The charge per unit jumped to 16% in 1931 and 25% in 1932–1933.[27] At that place is some contention nigh whether this can necessarily exist attributed to the tariff, however.[28] [29]

It was but during Globe War II, when "the American economy expanded at an unprecedented rate",[30] that unemployment fell below 1930s levels.[31]

Imports during 1929 were only 4.2% of the U.s. GNP, and exports were only 5.0%. Monetarists, such as Milton Friedman, who emphasize the central role of the money supply in causing the depression, consider the Smoot–Hawley Act to be simply a minor crusade for the US Great Depression.[32]

Terminate of tariffs [edit]

The 1932 Autonomous entrada platform pledged to lower tariffs. Afterward winning the election, President Franklin Delano Roosevelt and the now-Democratic Congress passed Reciprocal Trade Agreements Human activity of 1934. This act allowed the President to negotiate tariff reductions on a bilateral basis and treated such a tariff agreement every bit regular legislation, requiring a majority, rather than as a treaty requiring a two-thirds vote. This was one of the cadre components of the trade negotiating framework that adult later Earth War Ii. The tit-for-tat responses of other countries were understood to have contributed to a precipitous reduction of trade in the 1930s.[ citation needed ]

Later on Earth State of war II, that understanding supported a push towards multilateral trading agreements that would forbid similar situations in the future. While the Bretton Woods Understanding of 1944 focused on foreign exchange and did not directly address tariffs, those involved wanted a like framework for international trade. President Harry S. Truman launched this process in Nov 1945 with negotiations for the creation of a proposed International Trade Organization (ITO).[33]

As information technology happened, separate negotiations on the Full general Understanding on Tariffs and Trade (GATT) moved more chop-chop, with an agreement signed in October 1947; in the end, the United states never signed the ITO agreement. Adding a multilateral "most-favored-nation" component to that of reciprocity, the GATT served every bit a framework for the gradual reduction of tariffs over the subsequent half century.[34]

Postwar changes to the Smoot–Hawley tariffs reflected a general tendency of the United States to reduce its tariff levels unilaterally while its trading partners retained their high levels. The American Tariff League Written report of 1951 compared the gratuitous and dutiable tariff rates of 43 countries. Information technology institute that only seven nations had a lower tariff level than the Usa (5.1%), and 11 nations had free and dutiable tariff rates higher than the Smoot–Hawley peak of nineteen.8% including the United kingdom of great britain and northern ireland (25.6%). The 43-country average was 14.4%, which was 0.9% higher than the U.S. level of 1929, demonstrating that few nations were reciprocating in reducing their levels equally the United States reduced its own.[35]

In mod political dialogue [edit]

In the discussion leading up to the passage of the North American Gratuitous Trade Understanding (NAFTA) then-Vice President Al Gore mentioned the Smoot–Hawley Tariff as a response to NAFTA objections voiced by Ross Perot during a debate in 1993 they had on The Larry King Show. He gave Perot a framed moving-picture show of Smoot and Hawley shaking hands after its passage.[eleven]

In April 2009, and so-Representative Michele Bachmann made news when, during a speech, she referred to the Smoot-Hawley Tariff as "the Hoot-Smalley Act", misattributed its signing to Franklin Roosevelt, and blamed it for the Great Low.[36] [37] [38]

The act has been compared to the 2010 Foreign Account Revenue enhancement Compliance Act (FATCA), with Andrew Quinlan from the Center for Freedom and Prosperity calling FATCA "the worst economic idea to come out of Congress since Smoot–Hawley".[39]

Forced labor [edit]

Prior to 2016, the Tariff Act provided that "[a]ll goods, wares, articles, and trade mined, produced, or manufactured wholly or in part in any strange state by convict labor or/and forced labor or/and indentured labor nether penal sanctions shall non be entitled to entry at any of the ports of the Usa" with a specific exception known equally the "consumptive need exception", which allowed forced labor-based imports of goods where United States domestic production was not sufficient to see consumer demand.[40] The exception was removed under Wisconsin Representative Ron Kind's amendment bill, which was incorporated into the Trade Facilitation and Trade Enforcement Act of 2015, signed by President Barack Obama on 24 February 2016.[41]

Come across also [edit]

- State-of-origin labeling

- International merchandise

- Plant Patent Human action of 1930 (originally enacted as Title Three of the Smoot–Hawley Tariff Human action)

- Trade war

References [edit]

- ^ ch. 497, 46 Stat. 590, June 17, 1930, see 19 United statesC. § 1654

- ^ Taussig (1931)

- ^ WWS 543: Class notes, 2/17/10, Paul Krugman, February 16, 2010, Presentation, slide iv

- ^ "The Smoot-Hawley Trade War". Economic Periodical. 2022.

- ^ Alfred Due east. Eckes, Jr., Opening America'south Market: U.S. Foreign Trade Policy Since 1776 (Academy of North Carolina Press, 1995, pp. 100–03)

- ^ Whaples, Robert (March 1995). "Where Is In that location Consensus Among American Economic Historians? The Results of a Survey on Forty Propositions" (PDF). The Journal of Economic History. Cambridge University Press. 55 (1): 144. CiteSeerX10.1.1.482.4975. doi:10.1017/S0022050700040602. JSTOR 2123771.

- ^ The War: the root and remedy, George Skin, 1941

- ^ Beaudreau, Bernard C. (1996). Mass Production, the Stock Market Crash and the Great Depression. New York, Lincoln, Shanghi: Authors Choice Press.

- ^ Merill, Milton (1990), Reed Smoot: Apostle in Politics, Logan, UT: Utah Country Press, p. 340, ISBN0-87421-127-1 .

- ^ a b c Irwin, Douglas A.; Randall Due south. Kroszner (December 1996). "Log-Rolling and Economic Interests in the Passage of the Smoot–Hawley Tariff" (PDF). Carnegie-Rochester Briefing Serial on Public Policy. 45: 6. doi:x.1016/s0167-2231(96)00023-i. S2CID 154857884. Retrieved January 17, 2011.

- ^ a b c d "The Battle of Smoot–Hawley", The Economist, December 18, 2008 .

- ^ "1,028 Economists Ask Hoover To Veto Pending Tariff Neb: Professors in 179 Colleges and Other Leaders Assail Rise in Rates every bit Harmful to Country and Sure to Bring Reprisals" (PDF), The New York Times, May 5, 1930, archived from the original (PDF) on Feb 27, 2008 .

- ^ "Economists Against Smoot–Hawley", Econ Journal Watch, September 2007 .

- ^ "Shades of Smoot–Hawley", Time, October seven, 1985, archived from the original on October 29, 2010 .

- ^ Chernow, Ron (1990), The House of Morgan: An American Banking Dynasty and the Rise of Modern Finance, New York: Atlantic Monthly Printing, p. 323, ISBN0-87113-338-five .

- ^ a b Sobel, Robert (1972), The Historic period of Giant Corporations: A Microeconomic History of American Business, 1914–1970, Westport: Greenwood Printing, pp. 87–88, ISBN0-8371-6404-four .

- ^ Steward, James B. (March 8, 2018). "What History Has to Say about the 'Winners' in Merchandise Wars". The New York Times. No. International edition. New York, North.Y. Retrieved November 7, 2021.

- ^ Kris James Mitchener, Kirsten Wandschneider, and Kevin Hjortshøj O'Rourke. "The Smoot-Hawley Merchandise State of war" (No. w28616. National Agency of Economic Research, 2021) online.

- ^ Dark-brown, Wilson B. & Hogendorn, January S. (2000), International Economics: In the Historic period of Globalization, Toronto: University of Toronto Press, p. 246, ISBN1-55111-261-two .

- ^ Rhodri Jeffreys-Jones (1997). Changing Differences: Women and the Shaping of American Foreign Policy, 1917–1994. Rutgers University Press. p. 48.

- ^ https://world wide web.pewresearch.org/fact-tank/2018/03/22/u-s-tariffs-are-amid-the-lowest-in-the-earth-and-in-the-nations-history/

- ^ The Historical Statistics of the Usa, Colonial Times to 1970, Bicentennial Edition. Vol. Office ii. U.South. Demography Bureau. p. 888. Tabular array: Series U207-212 (Part 2 Cypher file: file named CT1970p2-08.pdf).

- ^ https://www.usitc.gov/documents/dataweb/ave_table_1891_2016.pdf[ blank URL PDF ]

- ^ Historical Statistics of the United states of america: Colonial Times to 1957. 1960.

- ^ Bureau of the Demography, Historical Statistics series F-one

- ^ Jones, Joseph Marion (June 21, 2003), "Smoot–Hawley Tariff", U.S. Department of Land, ISBN0-8240-5367-two, archived from the original on March 12, 2009 .

- ^ .

- ^ Eckes, p. 113

- ^ Douglas A. Irwin, "The Smoot–Hawley Tariff: A Quantitative Assessment", The Review of Economics and Statistics, Vol. 80, No.2, The MIT Printing, May 1998, pp. 332–33.

- ^ Tassava, Christopher. "The American Economy during World War Ii". EH.Net Encyclopedia, edited by Robert Whaples. February 10, 2008.

- ^ Bureau of Labor Statistics, "Graph of U.S. Unemployment Rate, 1930–1945", HERB: Resources for Teachers, retrieved April 24, 2015.

- ^ Milton Friedman and Anna Jacobson Schwartz, A monetary history of the United States, 1867–1960 (1963) p. 342

- ^ "Statement by the President on the Forthcoming International Briefing on Tariffs and Trade". Harry Due south. Truman Library & Museum.

- ^ "Empathise the WTO: The GATT years: from Havana to Marrakesh", Globe Trade System .

- ^ Lloyd, Lewis E. Tariffs: The Case for Protection. The Devin-Adair Co., 1955, Appendix, Table Half dozen, pp. 188–89

- ^ Steve Benen (Apr xxx, 2009). "'Hoot-Smalley'". Washington Monthly . Retrieved December x, 2021.

- ^ Eric Kleefeld (Apr 29, 2009). "Historian Michele Bachmann Blames FDR's 'Hoot-Smalley' Tariffs For Great Depression". Talking Points Memo . Retrieved December 10, 2021.

- ^ Matthew Yglesias (April 29, 2009). "Michelle Bachmann Embraces Ignorance, Reverse Causation". ThinkProgress. Archived from the original on May ii, 2009.

- ^ "Senator Rand Paul Introduces Neb to Repeal FATCA!".

- ^ Section 307 of the Tariff Act of 1930, quoted in Altschuller, S., U.S. Congress Finally Eliminates the Consumptive Demand Exception, Global Business and Human Rights, published by Foley Hoag LLP, 16 February 2016, accessed 22 November 2020

- ^ GovTrack.us, H.R. 1903 (114th): To amend the Tariff Human activity of 1930 to eliminate the consumptive demand exception to prohibition on importation of goods made with captive labor, forced labor, or indentured labor, and for other purposes, accessed 22 November 2020

Heavily featured in the volume "Dave Barry Slept Here: a sort of history of the United States" by Dave Barry.

Sources [edit]

- Archibald, Robert B.; Feldman, David H. (1998), "Investment During the Corking Low: Dubiousness and the Role of the Smoot–Hawley Tariff", Southern Economic Journal, 64 (4): 857–79, doi:10.2307/1061208, JSTOR 1061208

- Crucini, Mario J. (1994), "Sources of variation in real tariff rates: The United States 1900 to 1940", American Economic Review, 84 (3): 346–53, JSTOR 2118081

- Crucini, Mario J.; Kahn, James (1996), "Tariffs and Aggregate Economic Action: Lessons from the Smashing Depression", Periodical of Monetary Economics, 38 (3): 427–67, doi:x.1016/S0304-3932(96)01298-six

- Eckes, Alfred (1995), Opening America'south Market: U.Due south. Foreign Trade Policy since 1776, Chapel Hill: University of North Carolina Printing, ISBN0-585-02905-nine

- Eichengreen, Barry (1989), "The Political Economy of the Smoot–Hawley Tariff", Research in Economic History, 12: ane–43

- Irwin, Douglas (1998), "The Smoot–Hawley Tariff: A Quantitative Assessment" (PDF), Review of Economic science and Statistics, fourscore (two): 326–34, doi:x.1162/003465398557410, S2CID 57562207

- Irwin, Douglas (2011), Peddling Protectionism: Smoot–Hawley and the Corking Depression, Princeton University Press, ISBN978-0-691-15032-i

- Kaplan, Edward S. (1996), American Trade Policy: 1923–1995, London: Greenwood Press, ISBN0-313-29480-one

- Kottman, Richard Due north. (1975), "Herbert Hoover and the Smoot–Hawley Tariff: Canada, A Case Study", Journal of American History, 62 (three): 609–35, doi:10.2307/2936217, JSTOR 2936217

- Koyama, Kumiko (2009), "The Passage of the Smoot–Hawley Tariff Act: Why Did the President Sign the Bill?", Journal of Policy History, 21 (two): 163–86, doi:10.1017/S0898030609090071, S2CID 154415038

- McDonald, Judith; O'Brien, Anthony Patrick; Callahan, Colleen (1997), "Merchandise Wars: Canada'due south Reaction to the Smoot–Hawley Tariff", Periodical of Economic History, 57 (4): 802–26, doi:10.1017/S0022050700019549, JSTOR 2951161

- Madsen, Jakob B. (2001), "Merchandise Barriers and the Collapse of Earth Trade during the Nifty Depression", Southern Economic Journal, 67 (four): 848–68, doi:10.2307/1061574, JSTOR 1061574

- Merill, Milton (1990), Reed Smoot: Apostle in Politics, Logan, UT: Utah State Press, ISBN0-87421-127-1

- Mitchener, Kris James, Kirsten Wandschneider, and Kevin Hjortshøj O'Rourke. "The Smoot-Hawley Trade War" (No. w28616. National Bureau of Economic Enquiry, 2021) online.

- O'Brien, Anthony, "Smoot–Hawley Tariff", EH Encyclopedia, archived from the original on Oct 2, 2009

- Pastor, Robert (1980), Congress and the Politics of U.S. Strange Economic Policy, 1929–1976, Berkeley: Academy of California Printing, ISBN0-520-03904-one

- Schattschneider, East. E. (1935), Politics, Pressures and the Tariff, New York: Prentice-Hall – Archetype written report of passage of Hawley–Smoot Tariff

- Taussig, F. Due west. (1931), The Tariff History of the U.s. (PDF) (8th ed.), New York: One thousand. P. Putnam'south Sons

- Temin, Peter (1989), Lessons from the Neat Depression , Cambridge, MA: MIT Press, ISBN0-262-20073-2

- Turney, Elaine C. Prange; Northrup, Cynthia Clark (2003), Tariffs and Trade in U.S. History: An Encyclopedia

What Lesson Was Learned From The Imposition Of The Smootã¢â‚¬â€œhawley Tariff?,

Source: https://en.wikipedia.org/wiki/Smoot%E2%80%93Hawley_Tariff_Act

Posted by: robertsthenly.blogspot.com

0 Response to "What Lesson Was Learned From The Imposition Of The Smootã¢â‚¬â€œhawley Tariff?"

Post a Comment